cap and trade vs carbon tax canada

If the European Unions Emission Trading Scheme ETS accomplishes. In cap-and-trade the government sets a.

Where Carbon Is Taxed Overview

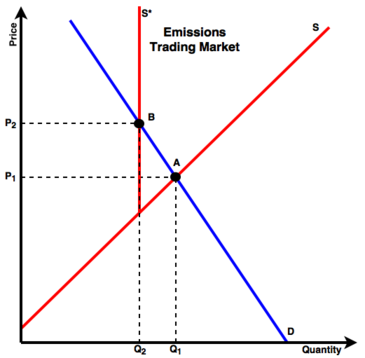

With a cap you get the inverse.

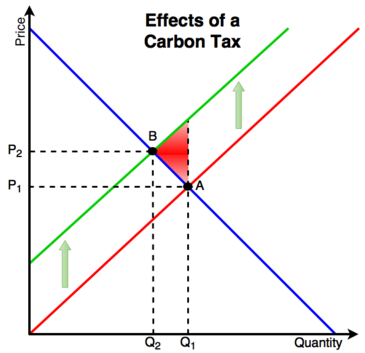

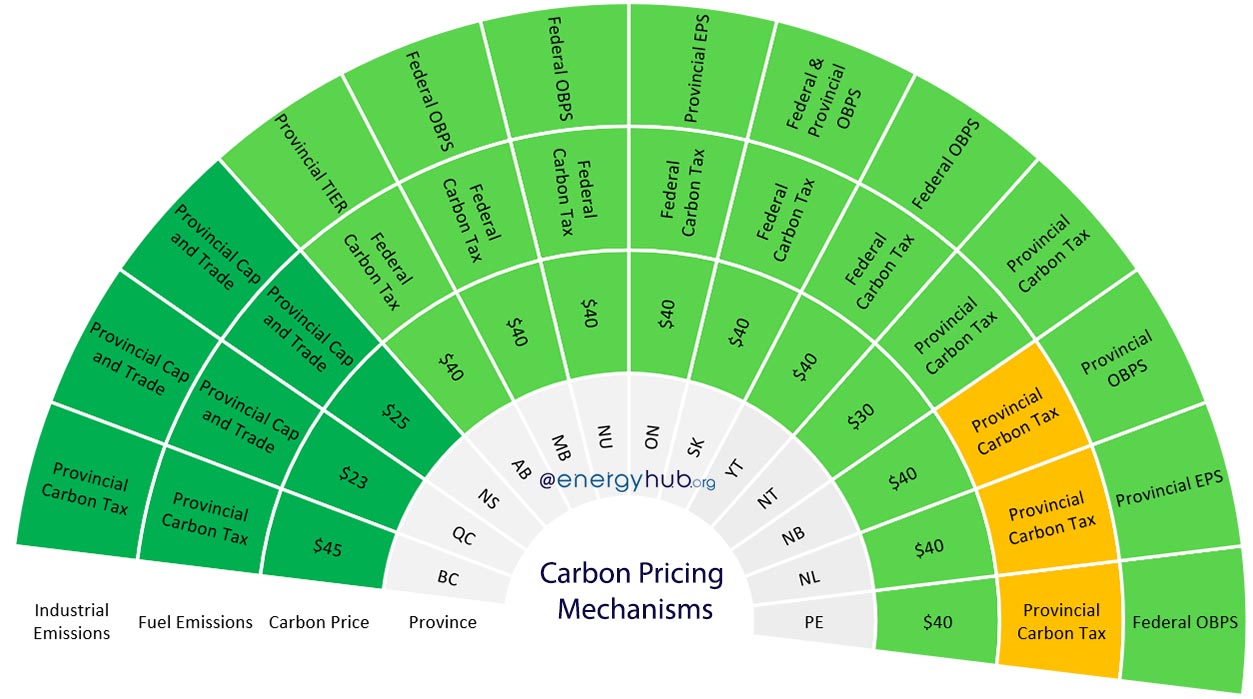

. A carbon tax and cap-and-trade system complement each other ensuring there is a price on CO2 emissions across the entire economy given that a cap-and-trade system typically covers large stationary sources of emission at the production end while a carbon tax addresses the consumption end. A carbon tax while not easy to implement across borders would be significantly simpler than a global cap-and-trade system. It provides more certainty about the amount of emissions reductions that will result and little certainty about the price of.

Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon taxes and cap and trade in the context of a possible future climate policy and does so by treating both instru-. Cap and trade or emissions trading is a common term for a government regulatory program designed to limit or cap the total level of specific chemical by-products resulting from private. Both can be weakened with loopholes and favors for special interests.

I have grave doubts that international agreements imposing a globalized so-called cap-and-trade system on CO2 emissions will prove feasible he wrote in his recent book The Age of. A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives. Carbon taxes vs.

The revenue generated from the taxation will also assist Canadians by ultimately facilitating greener practices by subsidization and funding environmentally conscious research. Cap-and-trade raises the prices of consumer goods and services as opposed to a carbon tax which is essentially a sales tax or a tax on consumption. There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some supporting carbon taxes and others favoring cap-and-trade mechanisms.

As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases. A cap-and-trade system through provi - sion for banking borrowing and pos - sibly a cost-containment mechanism. You can do the same to cap-and-trade.

Theory and practice Robert N. On the other hand political economy forces strongly point to less severe tar - gets if carbon taxes are used rather than cap-and-trade which is why envi-ronmental NGOs are opposed to the tax approach. How do the two major approaches to carbon pricing compare on relevant dimensions including but not limited to.

You can tweak a tax to shift the balance. The carbon tax system has been cited to both grow the economy. With a tax you get certainty about prices but uncertainty about emission reductions.

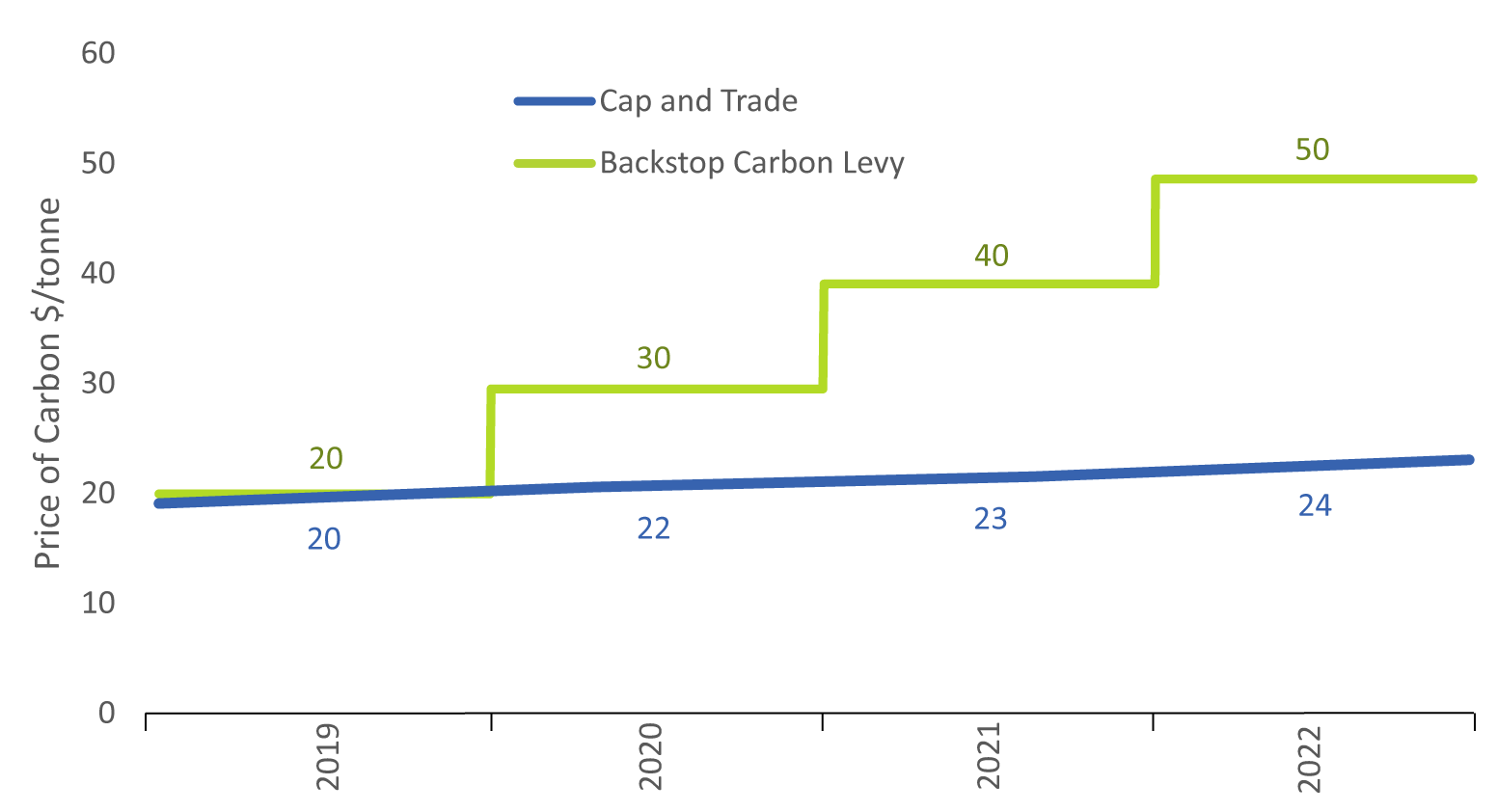

Quebec and Nova Scotia use cap-and-trade systems and Newfoundland and Labrador will raise its price to 50 a tonne later in 2022. Cap-and-trade has one key environmental advantage over a carbon tax. Political reality being what it is either is likely to impose a fairly low.

Finally the practicality of reducing emissions under a carbon taxation system is much more functional than the cap-and-trade program. Economic guru and former Federal Reserve Chairman Alan Greenspan has come out against cap and trade as an effective mechanism for reducing carbon emissions. This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument.

Carbon Tax Vs Emissions Trading Energy Education

Carbon Pricing Is Here To Stay In Canada What Is It Anyway Youtube

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

The Carbon Market A Green Economy Growth Tool

How To Design Carbon Taxes The Economist

Economist S View Carbon Taxes Vs Cap And Trade

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Carbon Tax Vs Emissions Trading Energy Education

Difference Between Carbon Tax And Cap And Trade Difference Between

Canadian Carbon Prices Rebates Updated 2021

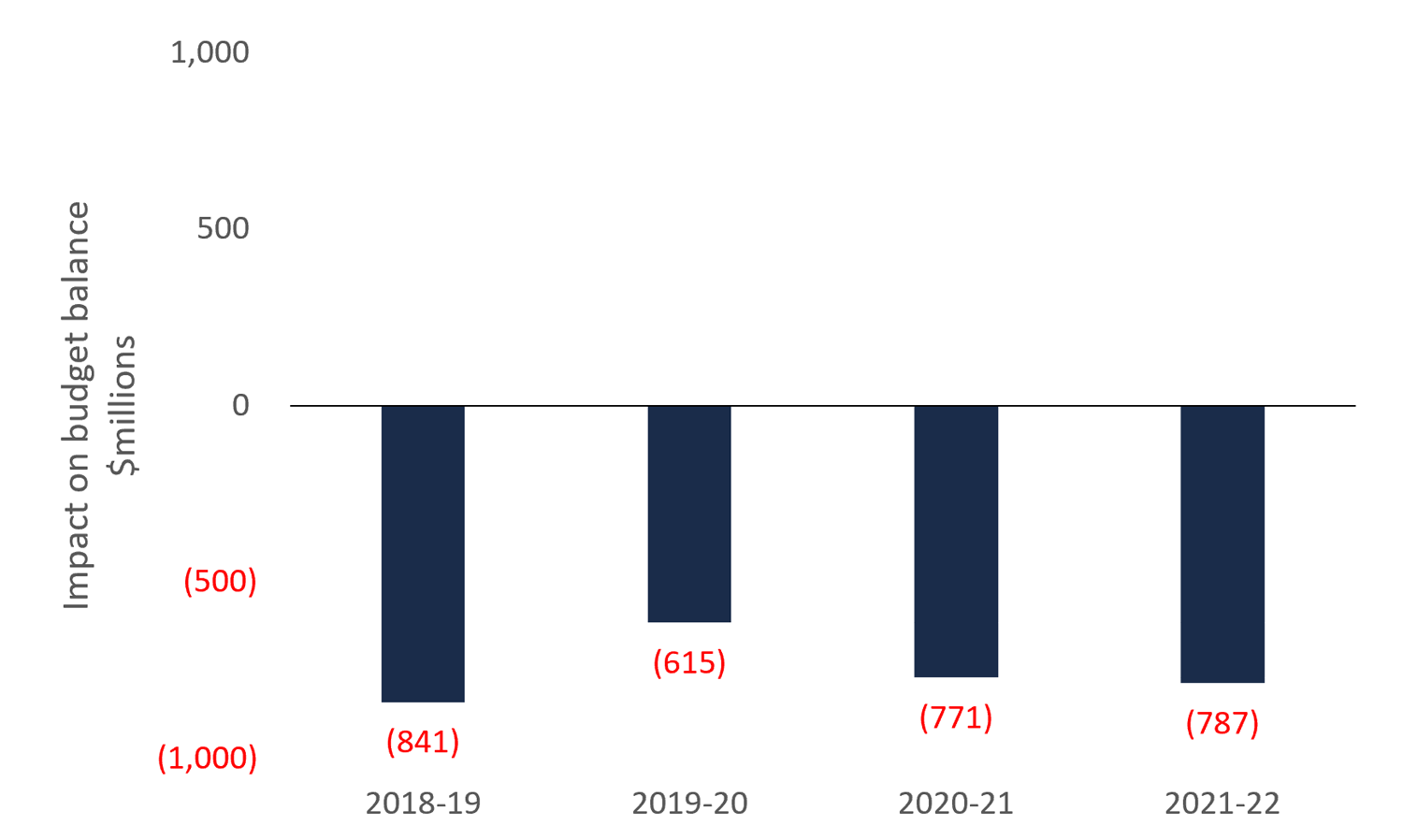

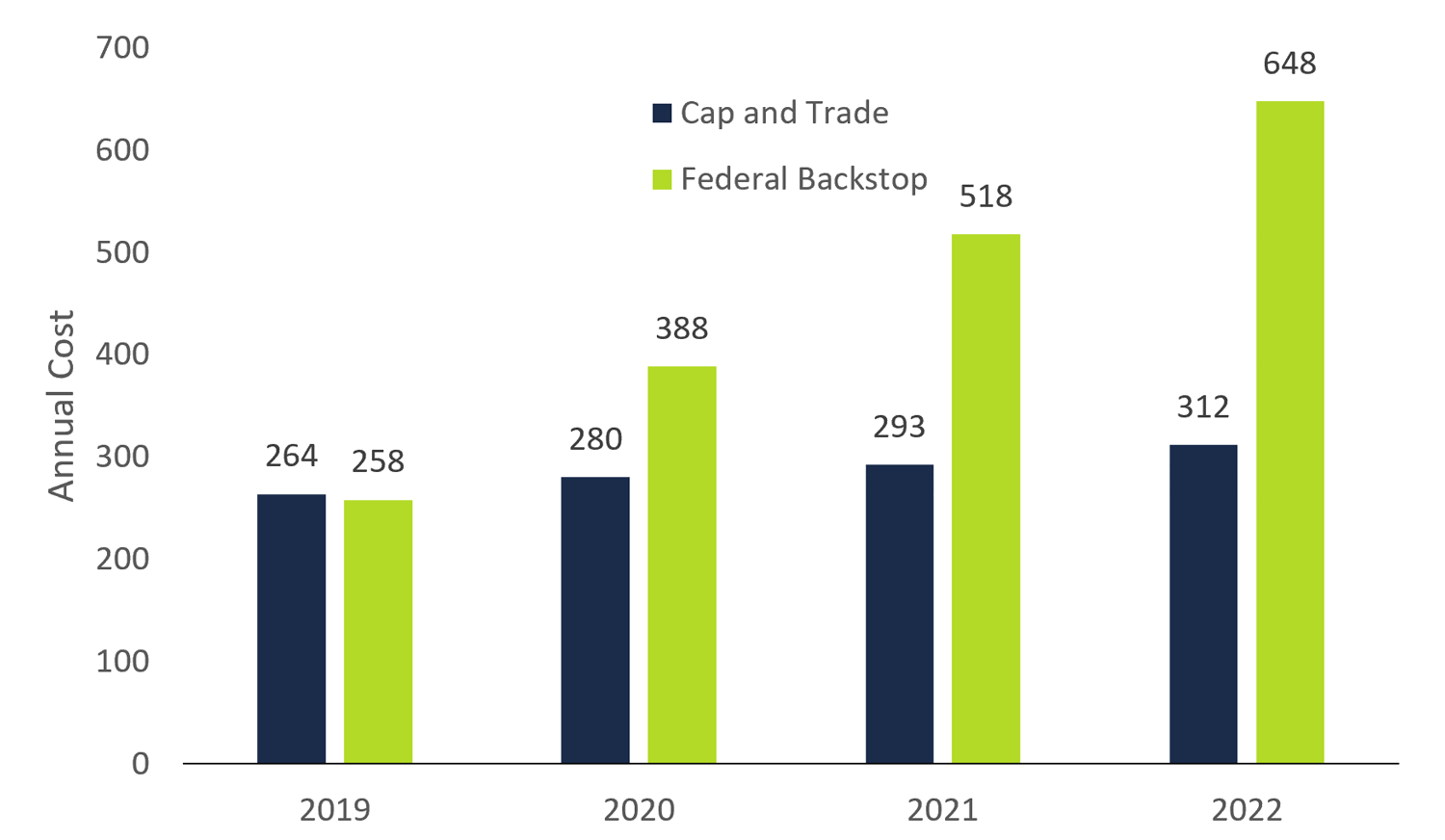

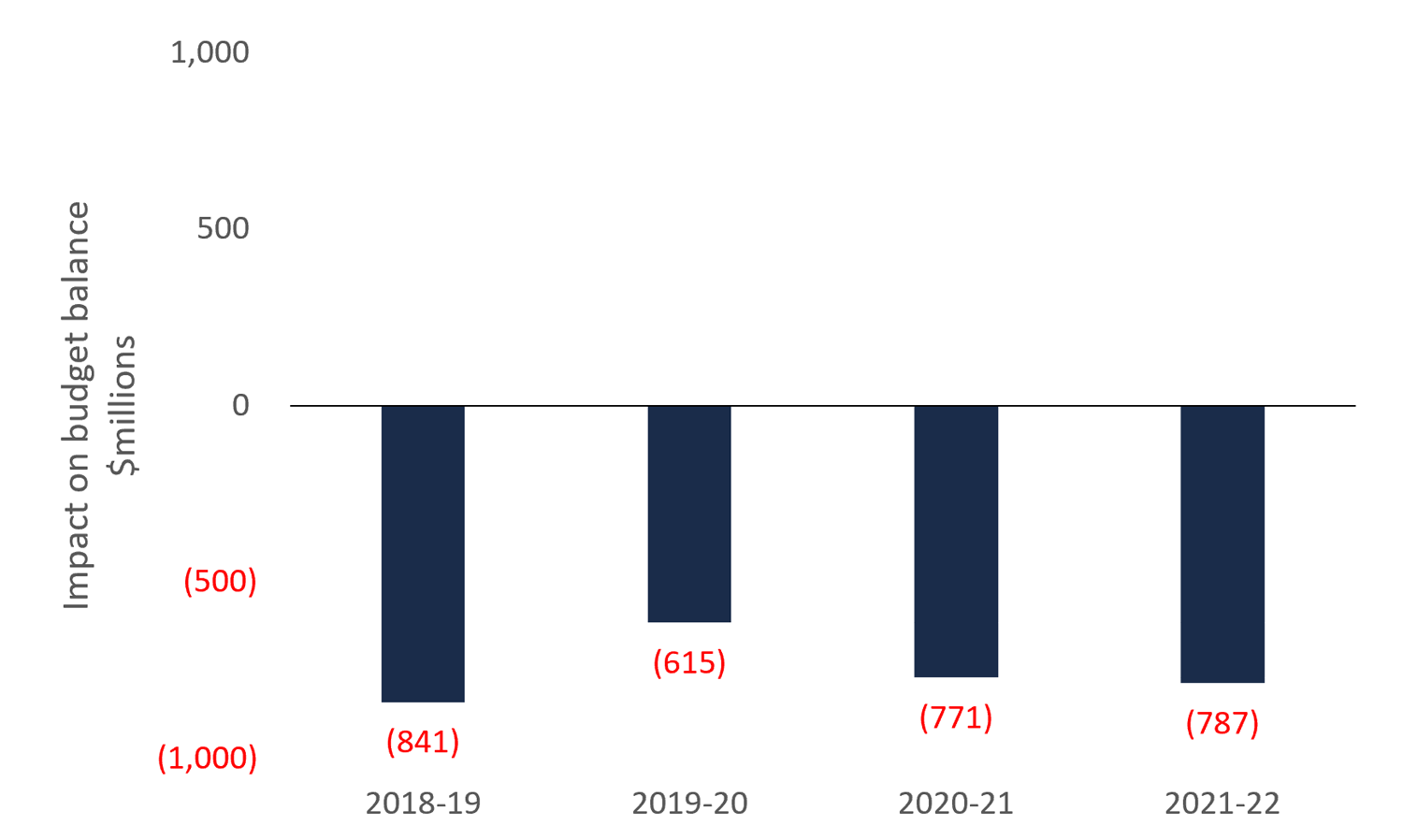

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Washington State Finally Passes A Cap On Carbon Emissions Grist

Cap And Trade Vs Taxes Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program